Contents

- 1.

- 2.

- 3.

Savvy award travelers know the trick to flexibility is collecting transferable points from programs such as American Express Membership Rewards®, Chase Ultimate Rewards®, Citi ThankYou Rewards, and Capital One.

These programs allow you to choose how you use your points. You can move your points to airline and hotel partners to book award flights and stays, or you can redeem your points for travel through the bank’s proprietary travel portal. Usually, you’ll want to choose the redemption option that costs the fewest points, but sometimes the choice isn’t so clear.

We’ll show you the pros and cons of transferring your points to an airline versus redeeming them through a travel portal to help you decide which method is best for your travel plans.

The pros and cons of redeeming your points in your credit card travel portal

Redeeming points for flights through a credit card travel portal works similarly to booking through an online travel agency such as Expedia or Priceline. You can search for flights based on your travel dates and preferences, and the portal gives you options from many airlines that you can filter by price, class of service, departure and arrival times, and more.

Your points have a fixed value when you redeem them through a travel portal — usually 1 cent apiece, with a handful of exceptions. You can also typically combine points and cash to pay for your ticket if you don’t have enough points to cover the full fare.

This is often the easiest method for using your points, but it’s not without pitfalls.

Pros:

Ease of use: You can search many airlines at a time, and you don’t have to learn about loyalty program partners and award charts or dig around for availability.

No blackout dates: Finding award seats on your desired travel dates through an airline program can be tricky, but booking through a portal offers much more flexibility.

Earn airline miles: Most airlines treat booking with points through a portal the same as booking with cash, so you’ll usually earn airline miles and elite status credits for your ticket (subject to the carrier’s rules).

Cover taxes and fees with points: Unlike award flight bookings, where you’ll often need to pay taxes and fees with cash, travel portal bookings allow you to pay the full fare (including taxes and fees) with points.

Cons:

Changes are more complicated: If you need to change or cancel your flight, you won’t be able to do so directly with the airline—you’ll have to deal with the travel portal, which can be a more complicated process.

Some airlines aren’t available: Travel portals don’t include every single airline or flight routing, so you may not see the best-value options for your trip.

Points are worth a fixed value: You’ll always get the same value for your points when you book through the portal, whereas redeeming points with an airline can sometimes get you a much higher value.

Pricing may be different. Portals may charge more for a seat than booking a cash fare directly with the airline, so it’s best to compare before you buy.

The pros and cons of redeeming your points by transferring them to an airline

Transferring points to airline loyalty program partners is a smart move if you want to squeeze the most value from your rewards, especially if you prefer booking pricey business or first class seats. While each program offers a different list of partners, you can often access flights on non-partner airlines by taking advantage of airline alliances and partnerships.

Booking flights by transferring your points to an airline takes a little more legwork, but the payoff can often be worth it.

Pros:

Outsized value for points: You’ll often pay fewer points by transferring to airline partners and booking award flights, resulting in a higher per-point value.

Book business and first-class flights for less: Paid premium cabin fares can be incredibly expensive, and the points price you’ll pay through a portal will be similarly high. However, award flight pricing can be significantly less.

Top-up your frequent flyer account: You may not have enough miles in your airline loyalty program account to book an award flight, but you can transfer flexible points to make up the difference.

Prevent miles expiration: Some airline loyalty program miles expire after a period of inactivity in your account. Transferring flexible points can reset the clock.

Cons:

Complexity: Learning about airline award charts, routing rules, and partnerships can be time-consuming and confusing. Plus, points transfers to airlines aren’t always instant.

Award availability: Just because you can book a flight with airline miles doesn’t mean seats are available. Some airline programs make it very difficult to find award seats, especially if you’re traveling as a group or during peak periods.

No miles earning: You won’t earn airline miles on award tickets.

Taxes and fees can be exorbitant: Some airlines tack on fuel surcharges and other hefty fees to award flights, which can erase the value you’ll get from your miles.

When you might want to redeem points with your credit card travel portal

It can make more sense to redeem points through a credit card portal if you prefer simplicity and don’t mind booking flights through a third party. Here’s when to consider using points with your credit card travel portal.

The portal costs fewer points

It can sometimes cost fewer points to book flights through a travel portal than transferring points to airlines for award flights. This is particularly true if the airfare is cheap (such as during an airline seat sale).

Your travel dates aren’t flexible

If you have firm travel dates and can’t find flight award availability through an airline program, booking through a travel portal still allows you to redeem points instead of paying cash. The same principle applies if you’re traveling as a group and can’t find enough award seats for your party or if you’re planning travel during peak travel times (such as the holiday season or spring break) and can’t piece together an award itinerary that works.

Fussing with award charts and rules doesn’t appeal

While some folks love to navigate complex airline award charts and rules to get the best value, not everyone has the time or inclination to do so. Your airline might not even partner with your credit card program, which isn’t necessarily a dealbreaker, but you may have to learn partner award redemption strategies to get the flight you want. Using credit card points through a travel portal is a straightforward way to book airfare without having to jump through these hoops.

You don’t have enough points for an award flight

Even if you don’t have enough points to cover your entire fare, using a travel portal can save you money by allowing you to combine cash and points. In many cases, using your credit card for the cash portion of the fare can earn you bonus rewards as well.

You’re trying to earn elite status

Travel portal bookings typically earn airline miles and elite status points or credits. If you’re working toward airline elite status, it could make sense to book flights through a portal to help you get closer to your goal.

When you might want to redeem your points by transferring them to the airline

If your travel plans are flexible and you’re willing to research available seats, you can often get a better deal by transferring points to airlines to book award flights.

Award seats are cheaper and available

If the award price for a flight is lower than the points you’d pay by booking through a portal, transferring points to an airline program makes the most sense. This is, of course, dependent on award seat availability, so don’t transfer points unless you’re sure you can get the seats you want.

You have all the points you need

While some airlines allow you to combine miles with cash, it’s usually not a good value compared to paying the full cost with miles. If you’ve got all the points required for a flight and don’t need to split between points and cash, transferring points to airlines can be a better deal.

You want a business or first class flight

You can often get outsized value from your points by transferring them to airlines to book fancy lie-flat seats in premium cabins. These tickets can cost thousands of dollars, but by booking with airline miles, you can get a rate of return that’s much higher than redeeming credit card points through a portal.

Maximizing rewards is your jam

For some, poring over award charts and stretching the most value from credit card points is a challenging and fun task. Booking a pricey flight with miles and minimal taxes and fees is incredibly rewarding and can make travel attainable for those on a budget. But even if you don’t want to invest hours into maximizing rewards, tools like point.me can help you easily find the cheapest award flights to book with the points you have on hand.

You might have to change or cancel

Some airlines have generous change or cancellation policies when booking award flights with miles. For example, if you need to cancel an American Airlines award flight, you’ll get all your miles and taxes/fees back without paying a cancellation or redeposit fee.

If you used points through a travel portal to book the same flight, you’d have to navigate the change or cancellation through the travel portal, and getting a refund or credit could be a lot more difficult, depending on the type of fare you booked.

Examples of redemptions in a credit card portal vs transferring them to the airline

Let’s look at a couple of examples where redeeming points through a credit card portal makes more sense than transferring them to an airline partner for award flights.

Cheap paid domestic flights

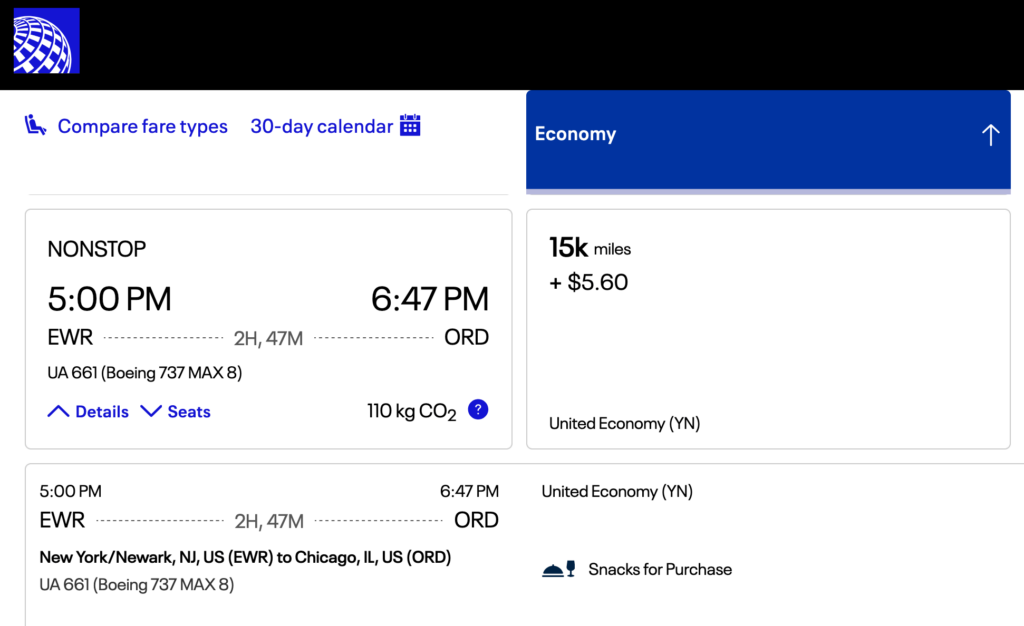

United Airlines charges 15,000 miles plus $5.60 for the economy class award flight below between Newark (EWR) and Chicago (ORD). United MileagePlus is a Chase Ultimate Rewards transfer partner, so if you have the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card, you can transfer 15,000 Chase points to United to book this flight.

However, that’s not the best idea in this case because the flight is inexpensive. When you book flights through Chase Travel℠, your Ultimate Rewards points are worth 1.25 cents apiece when you have the Sapphire Preferred or Ink Business Preferred and 1.5 cents each with the Sapphire Reserve.

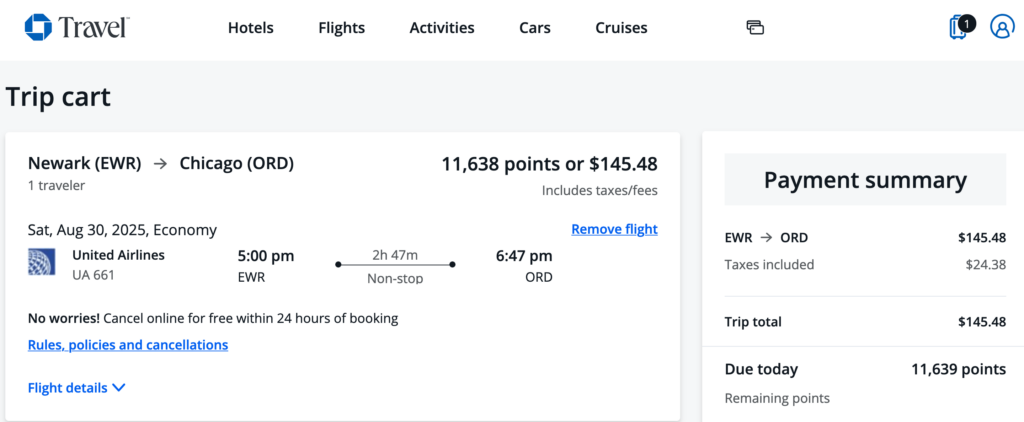

Through the Chase Travel portal (with points from the Ink Business Preferred), you’d pay just 11,639 points, including taxes and fees, for the exact same flight.

Airline seat sales

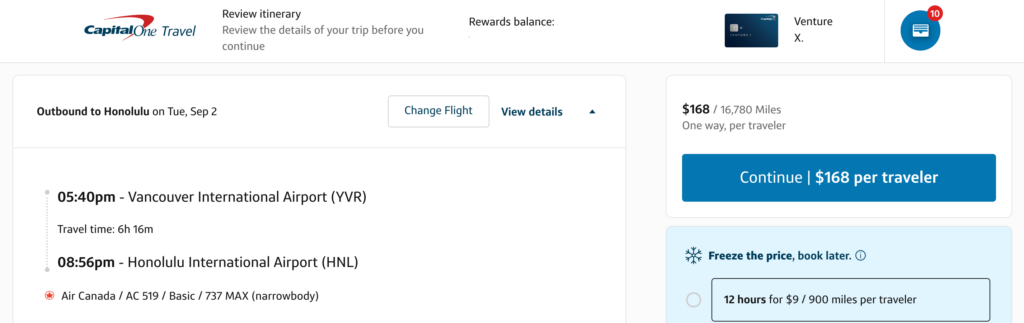

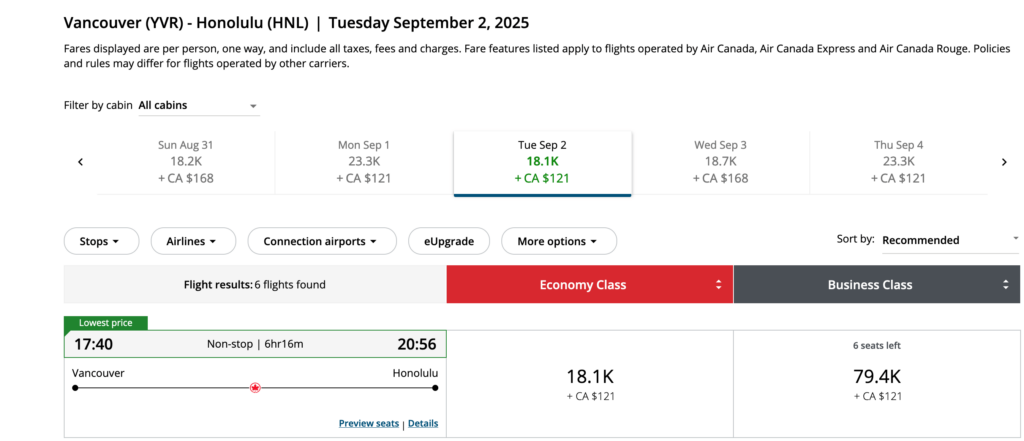

Sometimes, airlines run promotions with cheap tickets to certain destinations. For example, Capital One miles are worth 1 cent each when you book through Capital One Travel. This Air Canada economy class flight between Vancouver (YVR) and Honolulu (HNL) costs just 16,780 miles, including taxes and fees, when you redeem this way.

Air Canada Aeroplan is a Capital One transfer partner, but moving your miles to Aeroplan in this situation would get you a poorer value. The same flight booked as an Aeroplan award costs 18,100 points plus 121 Canadian dollars (about $84 at the time of writing). You’d end up spending 1,320 more Capital One miles through the transfer, plus you’d be on the hook for the taxes and fees.

Here’s an expert tip: Instead of redeeming Capital One miles directly through the Capital One travel portal, it’s better to use your Capital One card (such as the Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card) to pay for your ticket. The Venture X, for instance, earns 5x miles on flights booked through Capital One Travel, and the Venture earns 2x miles in this case.

Because you can redeem Capital One miles at a rate of 1 cent apiece to “erase” eligible travel charges from your card statement within 90 days of the purchase, you’ll redeem the same number of miles as you would have by booking through the portal. And you’ll earn Capital One miles on the booking when you use this method.

Now, let’s look at some situations where transferring points to airlines is a better deal.

Low-cost domestic award tickets

Many airlines use dynamic pricing versus a fixed award chart, which means the number of miles required for an award ticket can fluctuate significantly depending on demand, season, and other factors.

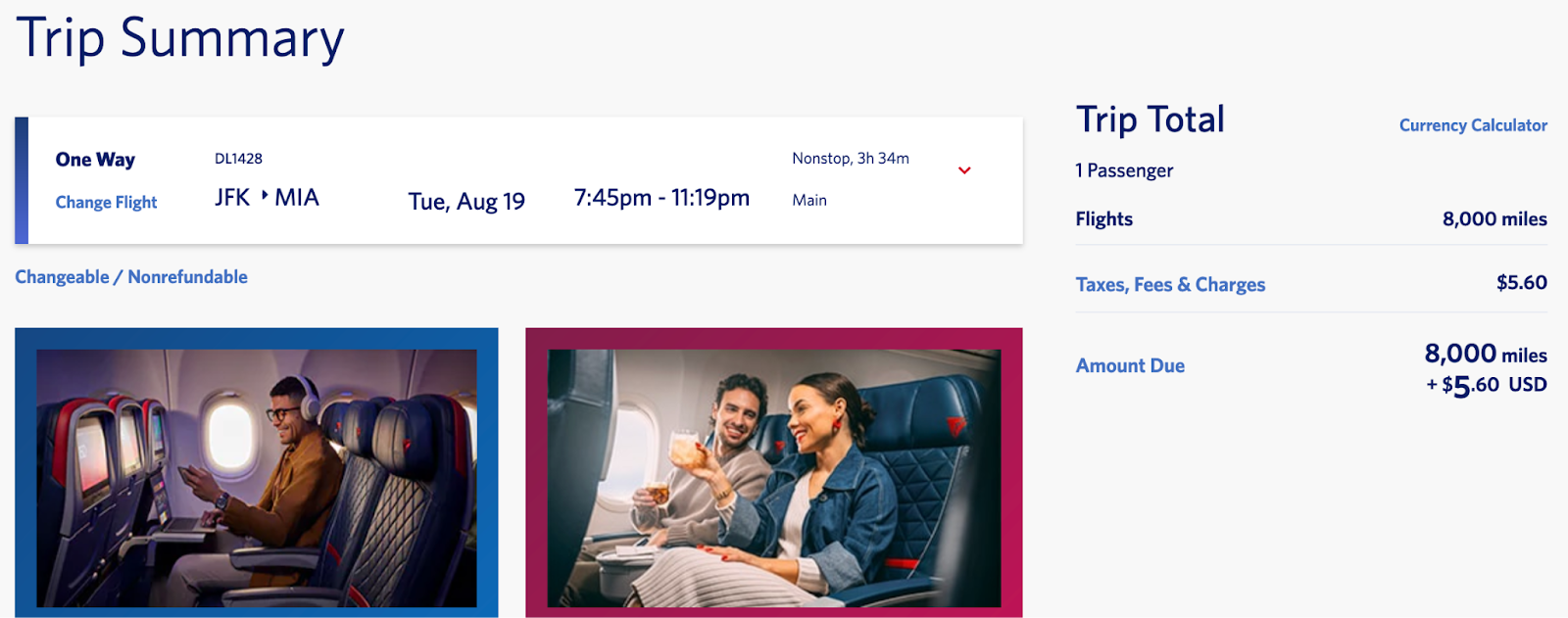

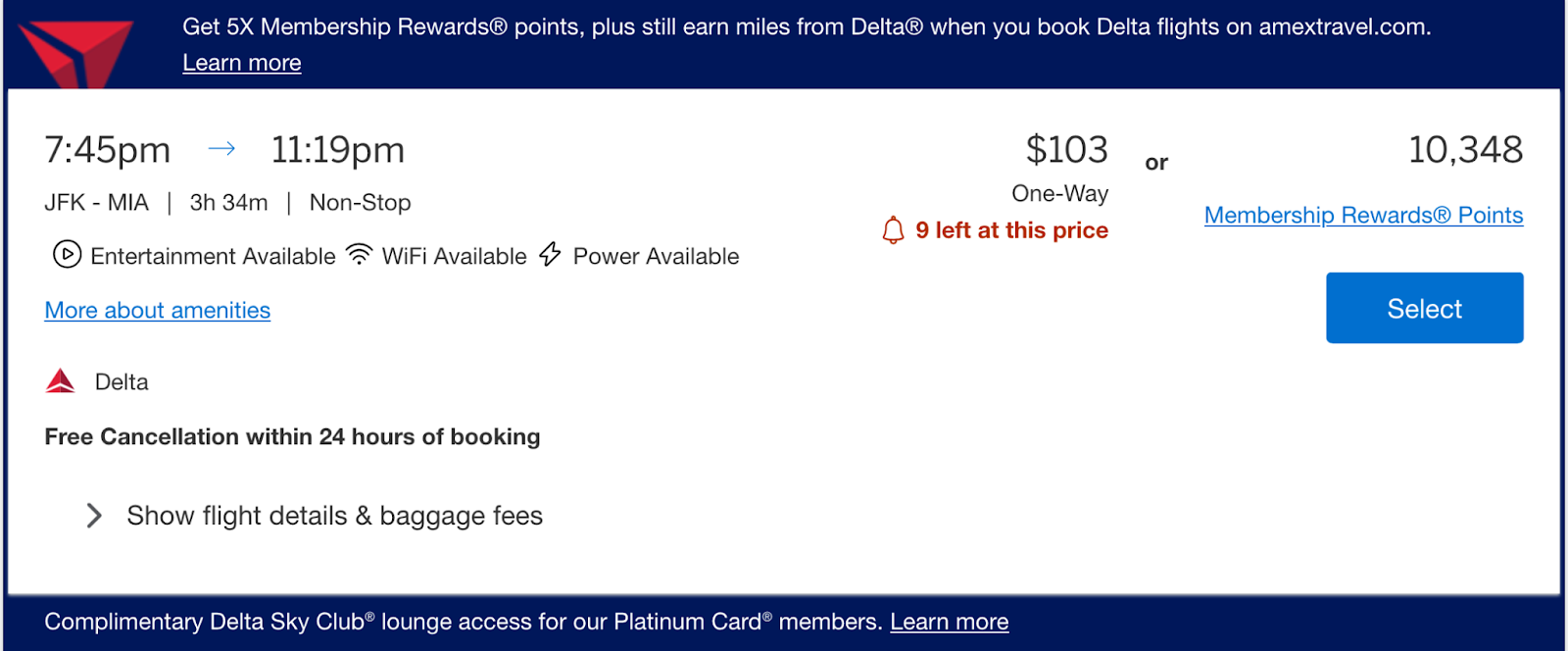

This can result in exorbitant pricing, but you’ll sometimes see relatively cheap flights as well. For instance, you could transfer 8,000 Amex Membership Rewards points to Delta SkyMiles to book the award flight below from New York (JFK) to Miami (MIA) — plus pay an additional $5.60 in taxes and fees.

That’s a better deal than redeeming points through Amex Travel, where they’re worth 1 cent each toward airfare. The same flight, despite also being inexpensive with cash, would cost you 10,348 Amex points, including taxes and fees — a difference of 2,348 points compared to transferring.

International business class

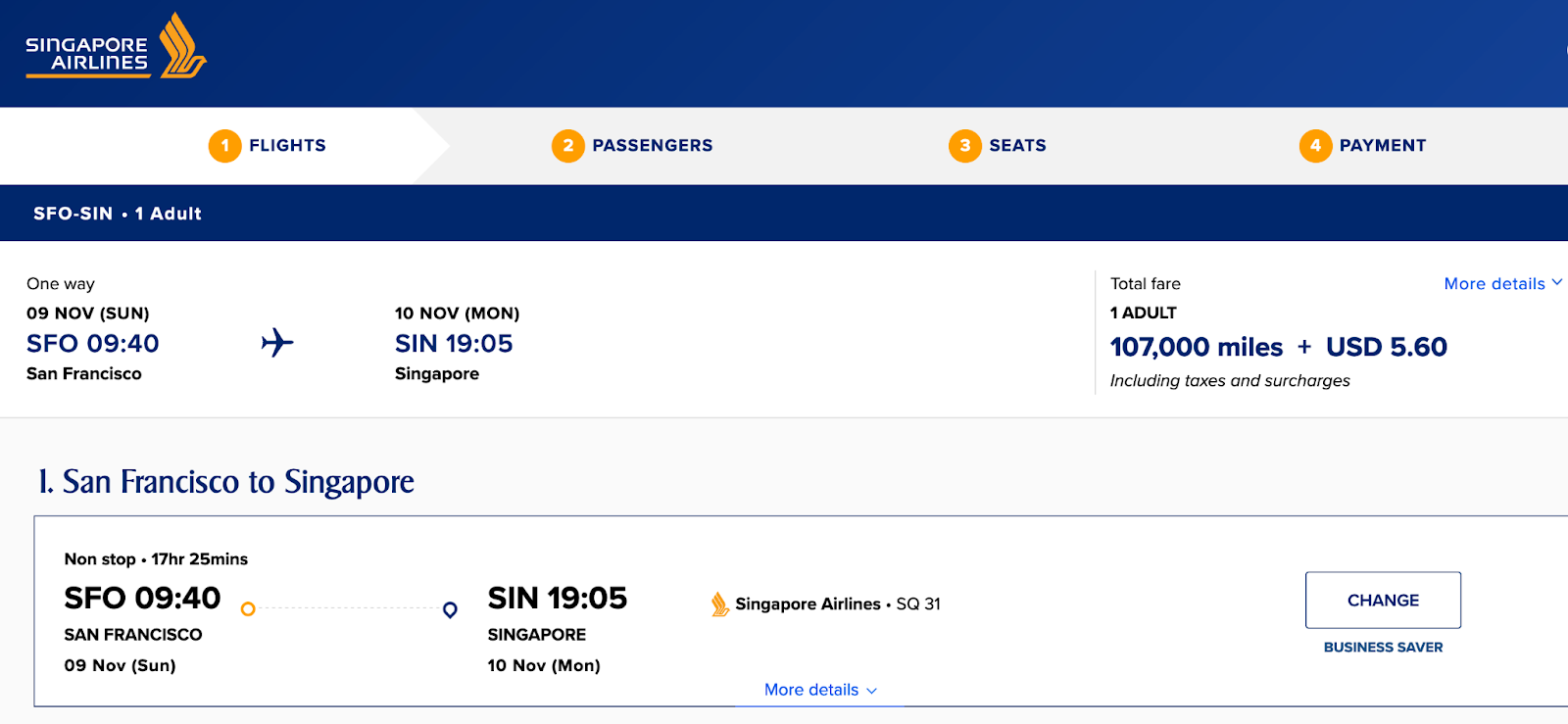

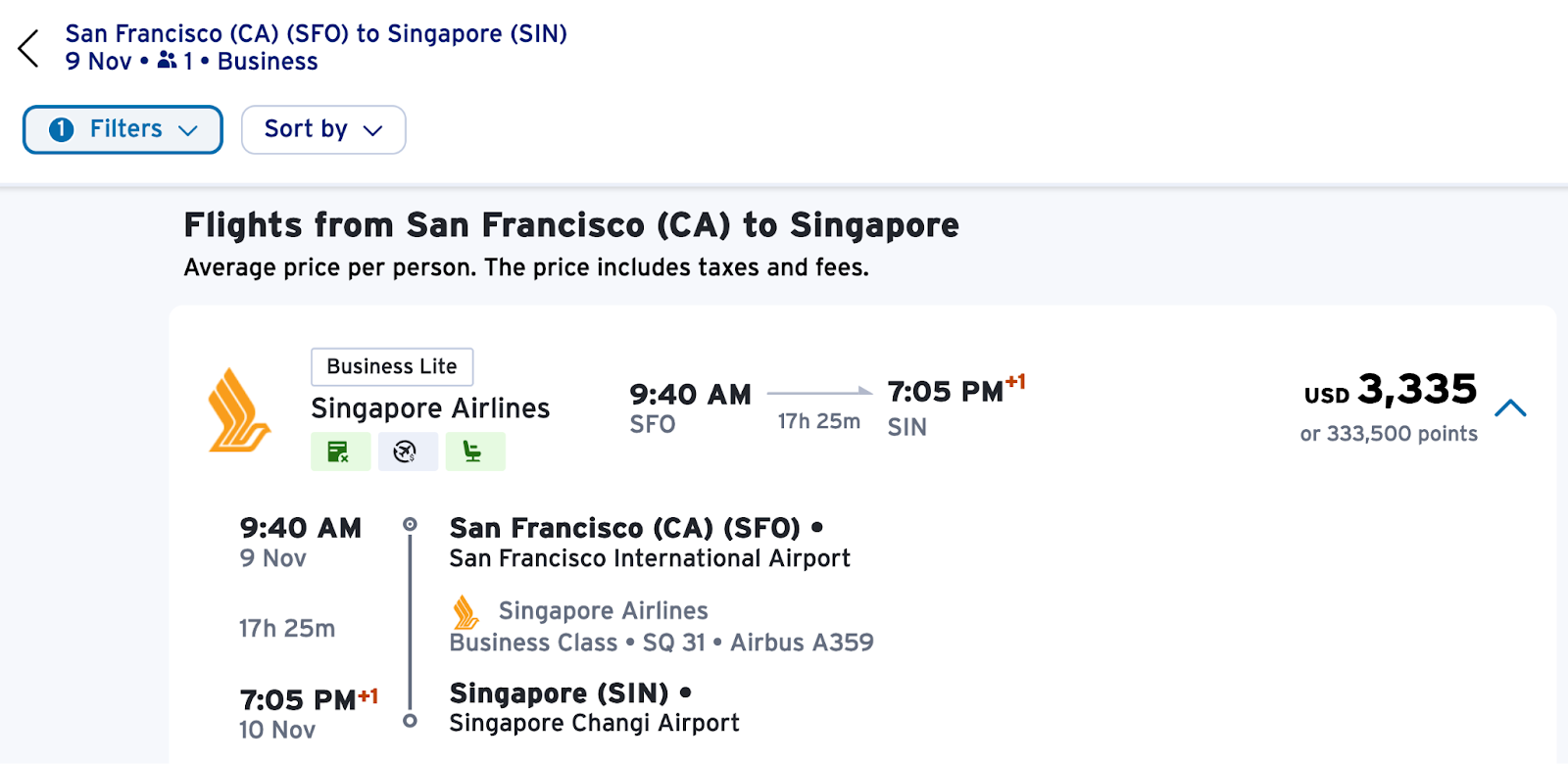

Business class flights can be incredibly pricey if you pay with cash, but redeeming miles for an award flight can result in significant savings. Here’s an example of an award flight from San Francisco (SFO) to Singapore (SIN) in a Singapore Airlines lie-flat business class seat for 107,000 Singapore miles and $5.60.

Singapore miles are easy to earn because Singapore Airlines KrisFlyer is a transfer partner of most major flexible points programs, including Amex Membership Rewards, Capital One, Chase Ultimate Rewards, and Citi ThankYou Rewards.

Suppose you want to use Citi ThankYou points from your Citi Strata Premier ℠ Card for this flight. You’re better off transferring your Citi points to Singapore Airlines rather than booking through Citi Travel at 1 cent per point. The cash fare of the same ticket is a whopping $3,335, or 333,500 Citi points. That’s 226,500 points more than you’d spend if you transferred points to Singapore to book this as an award flight instead!

International economy class

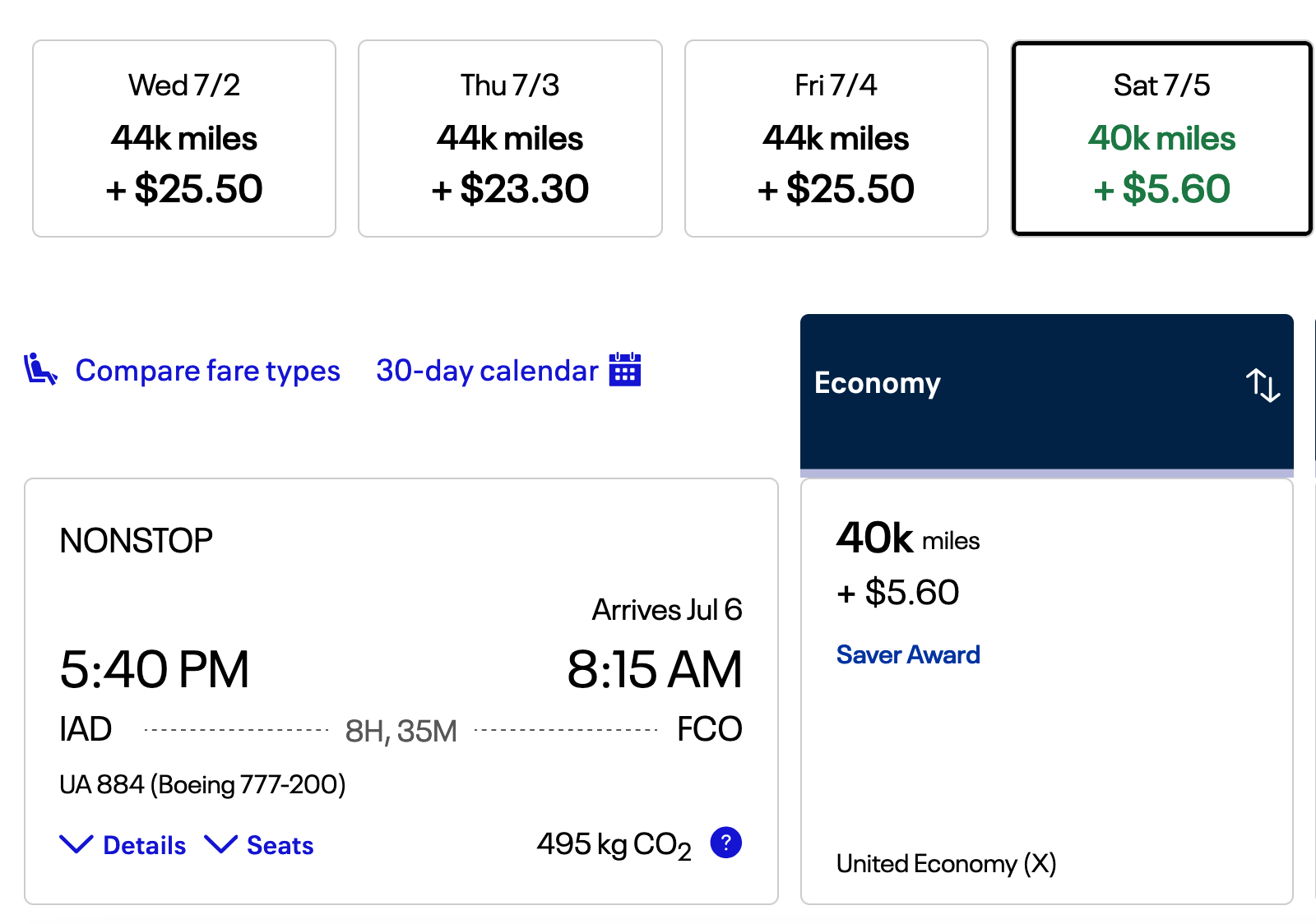

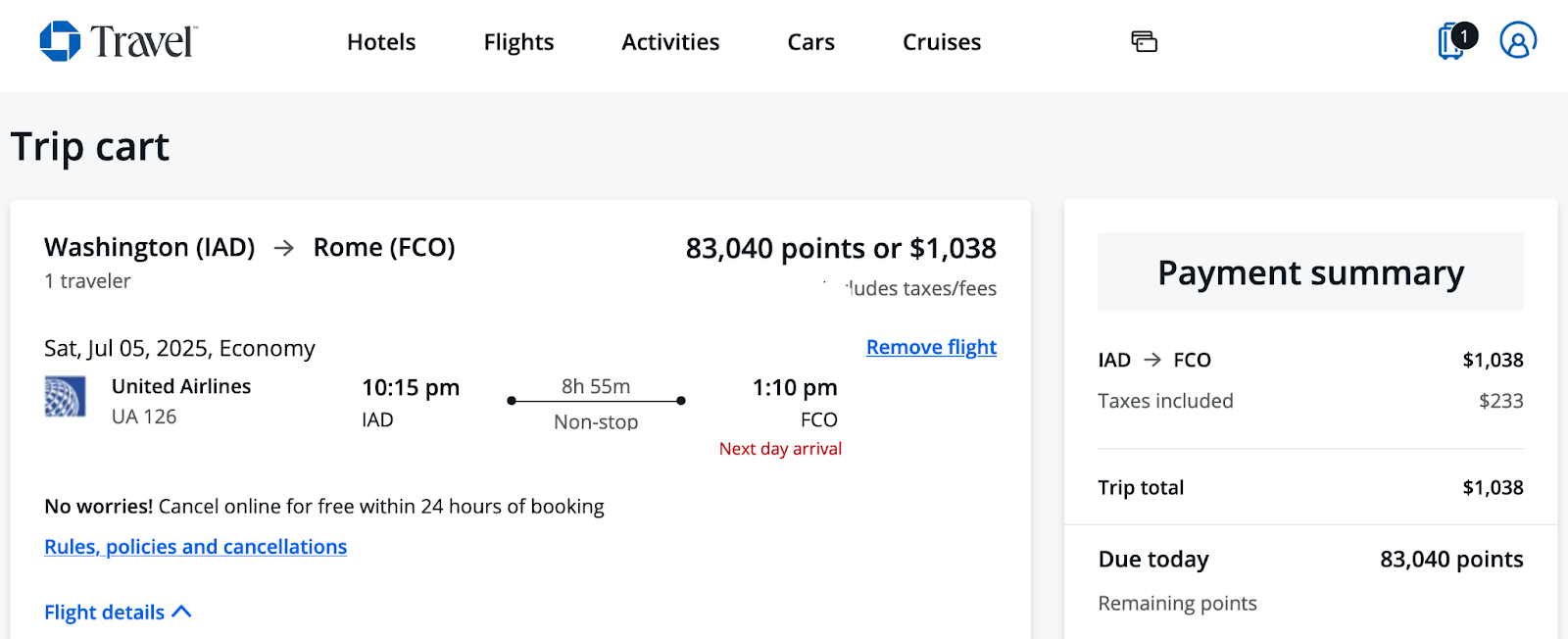

The same principle applies to international economy class flights, although the price difference might not be as significant. For example, if you’re planning a trip to Europe, you could book the United economy class flight from Washington Dulles (IAD) to Rome (FCO) below by transferring 40,000 Chase Ultimate Rewards points to United MileagePlus (with an additional $5.60 in taxes and fees).

Booking the same flight through Chase Travel using Ultimate Rewards points from the Ink Business Preferred (worth 1.25 cents each), you’d pay more than double the points — 83,040 in this case (including taxes and fees). The award flight is a much better value here.

Partner award flights

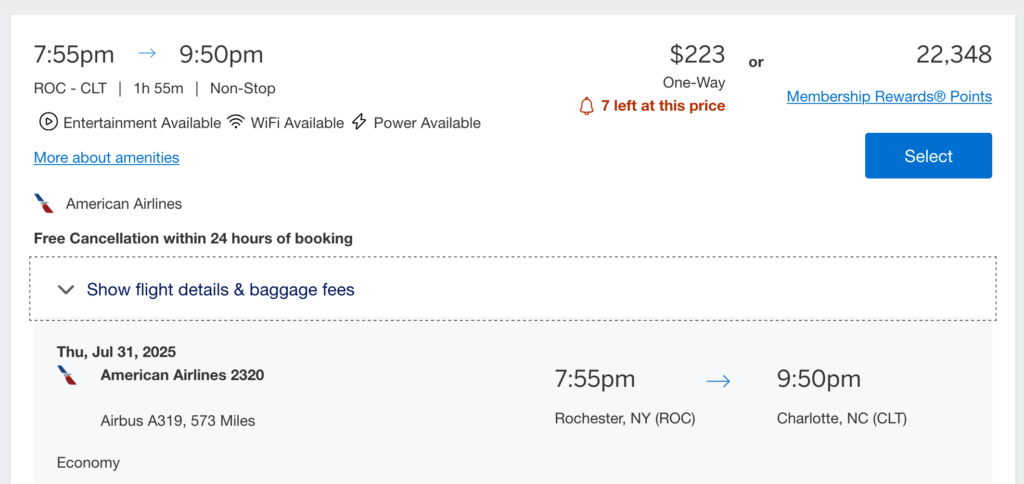

Even if the airline you want to fly isn’t a transfer partner of the flexible points program you’re using, you can often use a partner airline’s miles to book the flight you want. For example, American Airlines isn’t an Amex transfer partner, so you might think your only option for using points is with Amex Travel.

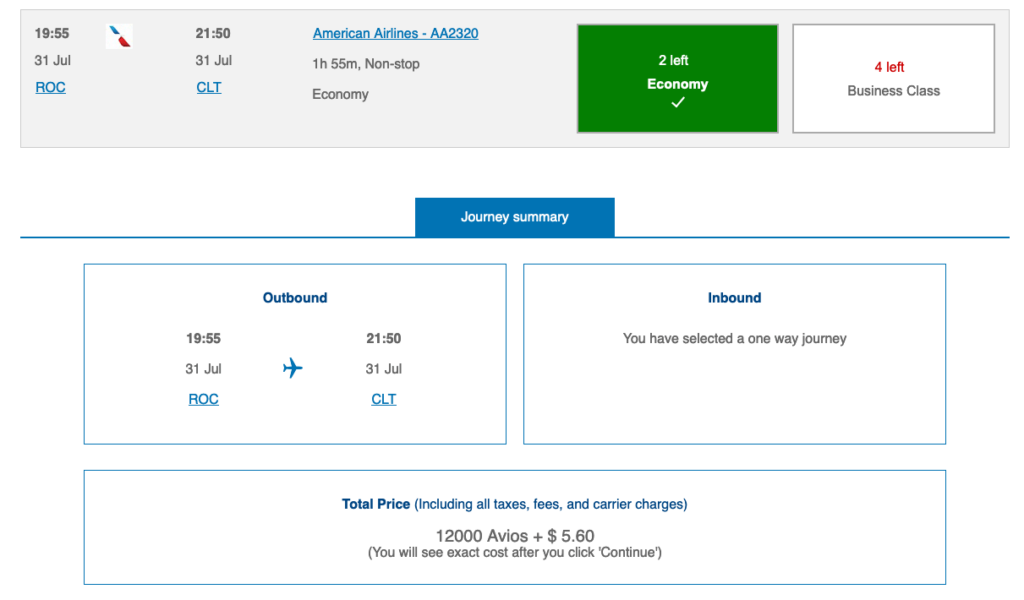

This sample American Airlines economy class flight from Rochester, New York (ROC) to Charlotte (CLT) costs $223 or 22,348 Membership Rewards points through Amex Travel.

But American Airlines is part of the Oneworld alliance, which also includes British Airways — and British Airways Executive Club is an Amex transfer partner. You could transfer just 12,000 Amex points to British Airways to book this American Airlines flight (plus $5.60 in taxes and fees) and save 10,348 points in the process.

Don’t fret if you’re not well-versed in airline partnerships and alliances — point.me can help by spotting these outside-the-box opportunities so you don’t have to.

Summary

You’ll often spend fewer points by transferring flexible rewards to airline partners for award travel, but that’s not always the case. Redeeming points through your issuer’s travel portal could save you points in some situations, such as when paid flights are cheap.

To make sure you’re getting the best deal, be sure to compare award and portal prices before you transfer points to an airline since transfers are irreversible.