Contents

- 1.

- 2.

- 3.

Advertiser Disclosure: Some links to credit cards and other products on this website will earn an affiliate commission. Compensation may affect how and where the cards appear on the site, and we do not include all card companies and all available card offers. Opinions, reviews, analyses, and recommendations have not been reviewed, endorsed, or approved by any of these affiliate entities. point.me has partnered with CardRatings for our coverage of credit card products. point.me and CardRatings may receive a commission from card issuers when a customer clicks on a link, when an application is approved, or when an account is opened.

If you’ve recently gotten engaged, you have a lot of decisions coming up — where to get married, who to invite, and what to eat on the special day. However, one of the most exciting parts of getting married actually comes after the wedding. Once all of the stress of the big day is over, you can relax or have the adventure of a lifetime with your partner on your honeymoon. Luckily, you can actually cover your honeymoon using points and miles earned from your wedding expenses.

If you’re looking for a complete guide on how to earn a free honeymoon from your wedding expenses, we have you covered. For planning purposes, let’s say you’re going to spend $33,000 on your June 2027 wedding. We’ll walk you through the cards we suggest and how to organize your spending. We’ll also include a few places you can visit with the points you earn.

Average cost of a wedding

Before we start, it’s helpful to have an estimate of what you might spend on your wedding. According to The Knot, the average wedding costs $33,000. Here’s how The Knot recommends breaking that down:

Venue and rentals (27%): $8,910

Catering, cake, and drinks (24%): $7,920

Photography and video (10%): $3,300

Floral and decor (9%): $2,970

Music (8%): $2,640

Attire and beauty (6%): $1,980

Wedding rings (5%): $1,650

Wedding planner (4%): $1,320

Guest entertainment (3%): $990

Transportation (2%): $660

Stationary (1%): $330

Officiant (1%): $330

That’s quite a lot of money to spend on one day, but you can easily turn these expenses into a free honeymoon.

General things to consider

Before deciding on which card (or cards!) to open, you’ll need to ask yourself a few things:

How much will I spend?: Just because the average cost of a wedding is $33,000, it doesn’t mean that you are required to spend that much. Your wedding could be more or less, so it’s helpful to set a rough budget so you know which cards best fit your spending habits.

When will I make the biggest payments?: Determining when you will make your payments will help you determine your application strategy. The last thing you want is to not meet the minimum spending requirement to earn a welcome bonus because you aren’t putting deposits down or making large payments.

In what categories will most of my spending occur?: Knowing in which categories you’ll spend the most money will help you select a card that earns bonus points in those categories. It’s also helpful to know how your transactions will code. For instance, a caterer might not code as dining, so using a card that earns bonus points on dining might not be helpful.

Where do I want to go on my honeymoon?: If you know where you want to go for your honeymoon, you can select a card that lists specific airlines or hotels as transfer partners, or opt for a co-branded card so you can earn elite status from your wedding spending.

Once you know the answers to these questions, you can develop your wedding points-and-miles strategy.

How to earn the most points and miles on your wedding spending

There are a few things you can do to maximize the points and miles you earn on your wedding spending.

Take advantage of sign-up bonuses

When you apply for a new credit card, you can earn a chunk of points or miles by meeting a minimum spending requirement. Sometimes, the minimum spending requirement can be high, requiring $8,000 or more in spending within a few months to qualify. For budget-conscious people, this can be hard to reach. However, if you’re planning a wedding and putting numerous deposits down in a short time frame, you’ll easily reach this threshold.

Utilize a 0% intro APR period

Not everyone has $33,000 sitting in their bank waiting to be spent. However, some credit cards offer 0% intro APR periods on new purchases for anywhere from 3 to 24 months from account opening. Although these cards typically have lower rewards, avoiding interest while making monthly payments for more than a year can save you a lot of money. If you can’t pay off your card in full every month, always calculate the interest you’ll pay on your balance against any increased rewards.

Check merchant offers

Almost all credit card issuers offer special merchant offers. These can let you receive a small statement credit on a purchase with a specific retailer, or earn bonus points on purchases with that retailer. These rotate frequently, so it’s always helpful to keep an eye on your current offers to maximize your earnings and savings.

Purchase through shopping portals

If you’re doing a lot of online shopping for your wedding, bachelorette party, engagement party, or honeymoon, make sure you use a shopping portal so you can earn bonus rewards or cash back on your purchases. I prefer Rakuten, which is added to my browser. If there are bonus cashback opportunities, Rakuten sends me an alert to activate the promotion.

Top cards to use for wedding expenses

Here are our picks for the best cards to use for your wedding expenses.

Capital One Venture X Rewards: Best for flat rate earnings

The Capital One Venture X is our top pick for your general wedding expenses because it earns 2 miles per dollar spent on all purchases. Although the $395 annual fee might scare some people off, it’s easily offset by a $300 annual travel credit for Capital One Travel bookings and 10,000 bonus miles each account anniversary.

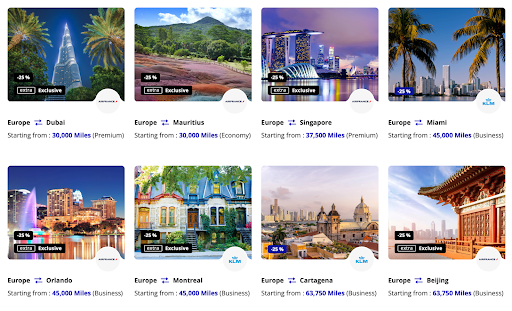

Plus, Capital One offers a variety of international airline transfer partners, including Avianca Lifemiles, Air France-KLM Flying Blue, and Singapore Airlines KrisFlyer. If you want to go abroad for your honeymoon, having access to these programs allows you to stretch your miles as far as possible.

The standard Venture X welcome offer is 75,000 bonus points after spending $4,000 on purchases within the first 3 months from account opening. This is a relatively easy threshold to meet, especially if you’re putting down a deposit for a venue or caterer.

American Express Platinum Card: Best for a lucrative welcome bonus

In most scenarios, your Platinum Card won’t be the card you’ll want to put all of your wedding expenses on — it earns just 1 Membership Rewards point per $1 spent on general purchases. However, your welcome offer could be as high as 175,000 Membership Rewards points after spending $8,000 in purchases within the first six months of account opening. These points could easily help you and your partner book an international business class flight, so it’s something to consider.

You’ll also earn 5 points per $1 spent on flights (up to $500,000 spent each year), and on prepaid hotels booked through American Express Travel. If you’re hosting an international wedding, you could pay for all of your flights with your Platinum Card and earn a slew of points you can use on your honeymoon.

Not to mention that the Platinum Card offers a variety of statement credits you could use to help offset some smaller expenses before your wedding. Want to start exercising before your wedding? Use the $75 quarterly Lululemon credit to buy some new workout gear and the $300 annual Equinox credit to start working out. Hosting a meal with the in-laws? Access sought-after reservations through Resy by linking your card, and take advantage of a $100 quarterly statement credit at over 10,000 U.S. Resy restaurants.

American Express Gold Card: Best for dining and groceries

The American Express Gold Card is the best option if you have to make large dining purchases. It’s a hit-or-miss whether your caterer will code as dining, so it’s best to verify this in advance. You’ll earn 4 Membership Rewards points per $1 spent at restaurants, up to $50,000 spent per year, and at U.S. supermarkets, up to $25,000 spent per year. This is a great card to select if you’re interested in the gift card strategy we outlined above. You’ll earn 4X points at supermarkets, and you can then use your gift cards for a variety of wedding purchases.

Chase Sapphire Preferred: Best for booking travel

The Chase Sapphire Preferred is a fan favorite for a reason. With a low $95 annual fee, you’ll receive a variety of benefits. You’ll earn 3 Chase Ultimate Rewards points on dining and 2X points on travel purchases. The card also comes with best-in-class travel coverage, which is perfect if you’re traveling far for your wedding or honeymoon.

Plus, on each account anniversary, you'll earn bonus points equal to 10% of your total purchases made the previous year. If you put all of your $33,000 wedding on your card this year, you'll receive 3,300 bonus points next year. It’s not much, but every little bit helps.

Don’t forget about Chase’s 5/24 rule, which states that you’ll be denied a new card if you’ve opened more than 5 cards with any issuer in the last 24 months. If you’re interested in a Chase card, whether the Sapphire Preferred or one of the hotel cards listed below, you should apply for these cards first.

Bank of America Travel Rewards credit card: Best for a 0% intro APR period

Although the 1.5 points per $1 spent on all purchases isn’t anything to write home about, the Bank of America Travel Rewards credit card is a solid option for your wedding expenses. It offers a 0% intro APR on purchases for 15 billing cycles from account opening.

Interest can quickly add up, so if you can’t pay off your wedding purchases in full by the due date, a card with an extended intro APR can save you a lot of money. 15 billing cycles give you more than a year to pay off your balance before you start accruing interest.

Unfortunately, Bank of America doesn’t offer transfer partners, so you’re limited in the ways you can redeem your points.

Co-branded hotel or airline cards: Best to prepare for honeymoon travel

If you already know where you want to go on your honeymoon, you can apply for a hotel or airline credit card with your preferred brand. The best option will ultimately depend on which brand you’re most loyal to, as each major hotel and airline offers at least one co-branded credit card.

Here are a few hotel options along with their most notable perks for honeymoon travel:

Marriott Bonvoy Boundless Credit Card: Earn 5 free night awards after spending $3,000 on purchases within three months from account opening—free nights valued up to 50,000 points per night. You’ll enjoy an additional free night up to 35,000 points each year as a cardholder.

World of Hyatt Credit Card: Receive one free night at any Category 1-4 hotel each year after your Cardmember anniversary, and another free night at any Category 1-4 hotel after spending $15,000 in a calendar year. Also receive automatic World of Hyatt Discoverist status.

Hilton Honors American Express Aspire Card: Receive automatic Hilton Honors™ Diamond status, up to $400 in annual Hilton Resort credits, and an annual Free Night Reward. Earn an additional Free Night Reward after spending $30,000 in a calendar year.

IHG One Rewards Premier Credit Card: Earn a free night valued at 40,000 points each anniversary year. You’ll also earn a $100 statement credit and 10,000 bonus points after spending $20,000 each calendar year. Cardholders receive automatic Platinum elite status.

And here are a few airline options:

Delta SkyMiles Reserve American Express Card: Receive an annual companion certificate valid for Delta First within the U.S. and to Mexico, the Caribbean, or Central America each year. Also receive a $200 annual Delta Stays credit and access to Delta Sky Club and Centurion Lounges.

United Quest Card: Receive a 10,000-mile discount on an award booking each year, and another after spending $20,000 in a calendar year. Receive a $200 United travel credit each year.

Citi / AAdvantage Globe Card: Receive a $99 annual companion certificate valid for main cabin round-trip domestic travel. Also receive a $100 annual Splurge Credit and 4 Admirals Club passes each year.

Southwest Rapid Rewards Premier Card: Receive 6,000 bonus points and a 15% flight discount each anniversary year. Enjoy Group 5 boarding and a complimentary preferred seat.

In other words, if you applied for the Delta SkyMiles Reserve and the Marriott Bonvoy Boundless, you could book a buy-one-get-one first-class plane ticket to anywhere in the U.S. (including Alaska and Hawaii), the Caribbean, or Central America, and then stay for free at a Marriott for up to five nights. Then, all the additional points you earn from your spending can be used to extend your trip or book activities.

Building a winning combination of cards

The exact number of points will depend on which card you decide to apply for, but here’s a rough estimate on how many points you’ll earn using a few of the cards from our list, and where you could go using those points. The best option would be to use a combination of cards to maximize your earnings and redemption options.

For instance, you could apply for the Capital One Venture X and earn its welcome bonus by putting all non-bonus category spending on your card. Next, you could apply for the American Express Gold Card, which allows you to purchase gift cards through supermarkets to earn bonus points, as well as earn extra points on dining purchases related to your wedding. Finally, you could apply for a few co-branded cards, such as the Delta SkyMiles Reserve and the Marriott Bonvoy Boundless, to prepare for your honeymoon.

In practice, here’s how many points you’ll earn on a $33,000 wedding:

Capital One Venture X: 105,000 Capital One miles — 75,000 bonus miles from the welcome offer, plus 30,000 miles from non-bonus category spending (roughly $15,000).

American Express Gold Card: 100,000 Membership Rewards — 60,000 bonus points from the welcome offer, plus 40,000 points from bonus category spending (roughly $10,000)

Delta SkyMiles Reserve: 105,000 SkyMiles — 100,000 bonus miles, plus 5,000 SkyMiles (roughly $5,000)

Marriott Bonvoy Boundless: 5 free night awards from the welcome offer, plus 6,000 to 9,000 points (roughly $3,000).

That’s over 300,000 points you can use on your honeymoon. With this combination of cards, you’d be able to purchase a buy-one-get-one first-class ticket to your honeymoon, enjoy up to five nights at a Marriott hotel free of charge, and use the Capital One miles and American Express Membership Rewards points you earn from your spending to extend your vacation or book additional experiences on-site.

Here’s a look at how you can use those points.

If you take advantage of Air France Flying Blue promo fares, you can fly from the East Coast to Europe for just 45,000 miles round-trip in business class. That’s a total of 90,000 Flying Blue miles for two business class seats, which can be transferred at a 1:1 ratio from Capital One.

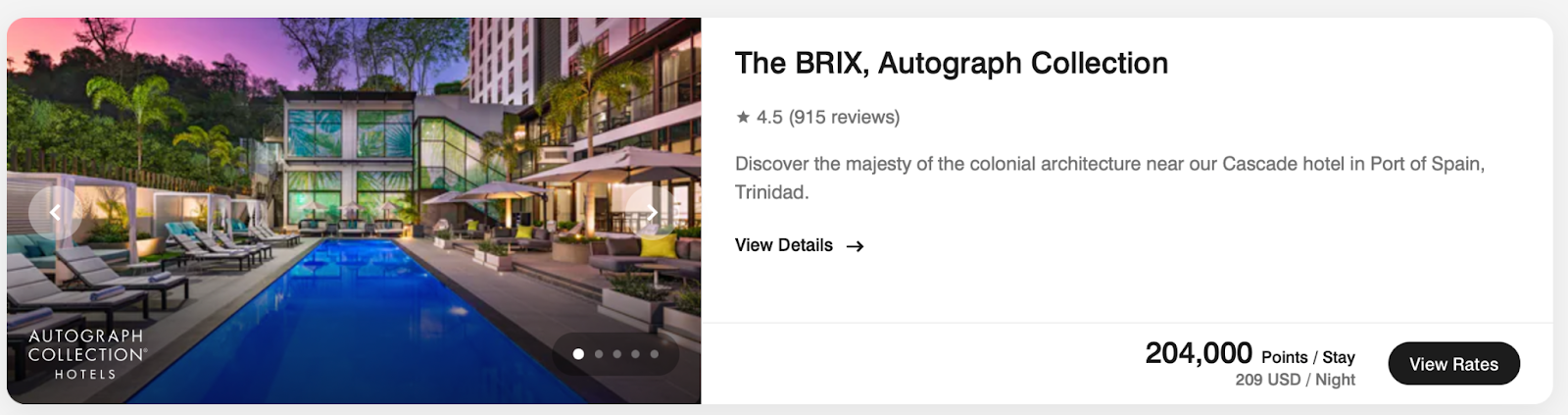

Or, you could utilize your companion certificate to book a trip to the Caribbean. Although you’ll still have to pay for one flight, you can use your Marriott free night certificates for a free hotel stay. For instance, you could book a 5-night stay at The BRIX, an Autograph Collection hotel, in Port of Spain, Trinidad.

If you want to stay for longer, you can transfer your American Express Membership Rewards points at a 1:1 ratio to Marriott Bonvoy.

With over 100,000 points sitting in each of your Capital One, American Express, and Delta accounts, there are almost unlimited options for where you can enjoy your honeymoon. Plus, you can utilize point.me to find fantastic deals on airfare, no matter where you want to go or which transfer partners you have access to.

Bottom line

If you’re strategic, you can certainly earn a free honeymoon from the money you’re already planning on spending on your wedding. Weddings are costly, so it helps make it more palatable if you know you get a free vacation out of it. With so many cards on the market, the best options will ultimately depend on your spending habits and financial goals. However, whenever you have large purchases coming up, it's a great time to earn a welcome bonus on a new card.

Advertiser Disclosure: Some links to credit cards and other products on this website will earn an affiliate commission. Compensation may affect how and where the cards appear on the site, and we do not include all card companies and all available card offers. Opinions, reviews, analyses, and recommendations have not been reviewed, endorsed, or approved by any of these affiliate entities. point.me has partnered with CardRatings for our coverage of credit card products. point.me and CardRatings may receive a commission from card issuers when a customer clicks on a link, when an application is approved, or when an account is opened.

Delta SkyMiles Reserve American Express see rates and fees, American Express Gold Card terms apply; see rates and fees, American Express Platinum Card terms apply; see rates and fees.