Contents

- 1.

- 2.

- 3.

When point.me member Cortney C. wanted to take her family to Costa Rica, she braced herself for sticker shock. She hoped to mitigate some of the cost by using the points she’d accumulated from her credit cards, but she was surprised to find she had more than enough to cover all of the flights — and then some. “We ended up getting six flights for 136,000 miles total,” she says. “It was like finding $6,000 I didn't know we had.”

The windfall was so substantial that Cortney could upgrade her family's hotel and even bring along her in-laws. "I was absolutely shocked that we could book this trip using the points and miles that we already had. I had thought it would take us years to save up for it."

Cortney's story isn't unique — it's symptomatic of a massive blind spot in American personal finance. A recent survey of 2,000 Americans reveals that millions are sitting on travel fortunes they don't even realize exist.

The Great American points blind spot

The numbers are staggering: while 71% of Americans carry points-earning credit cards, they're walking around with hidden wealth they can't see.

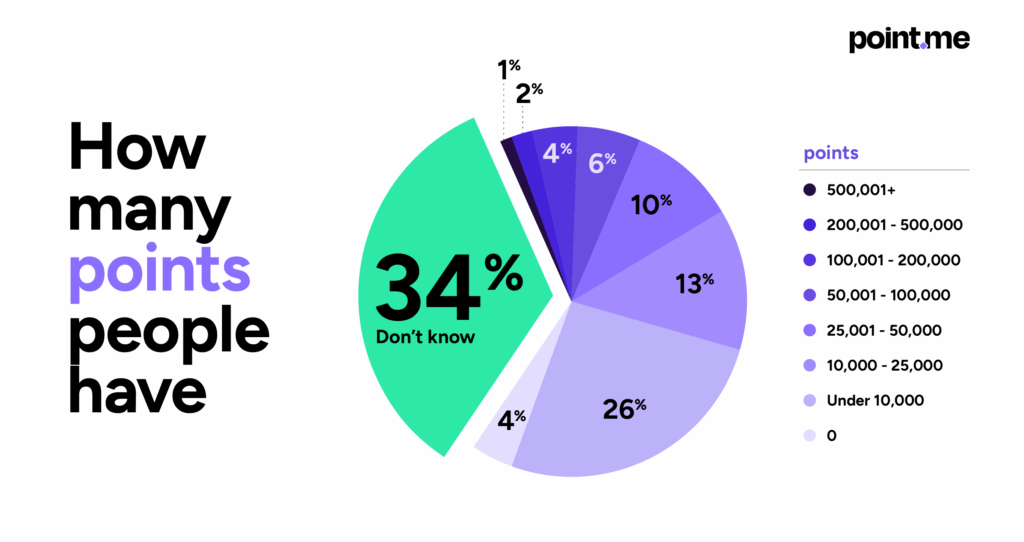

34% have no idea how many points they actually have

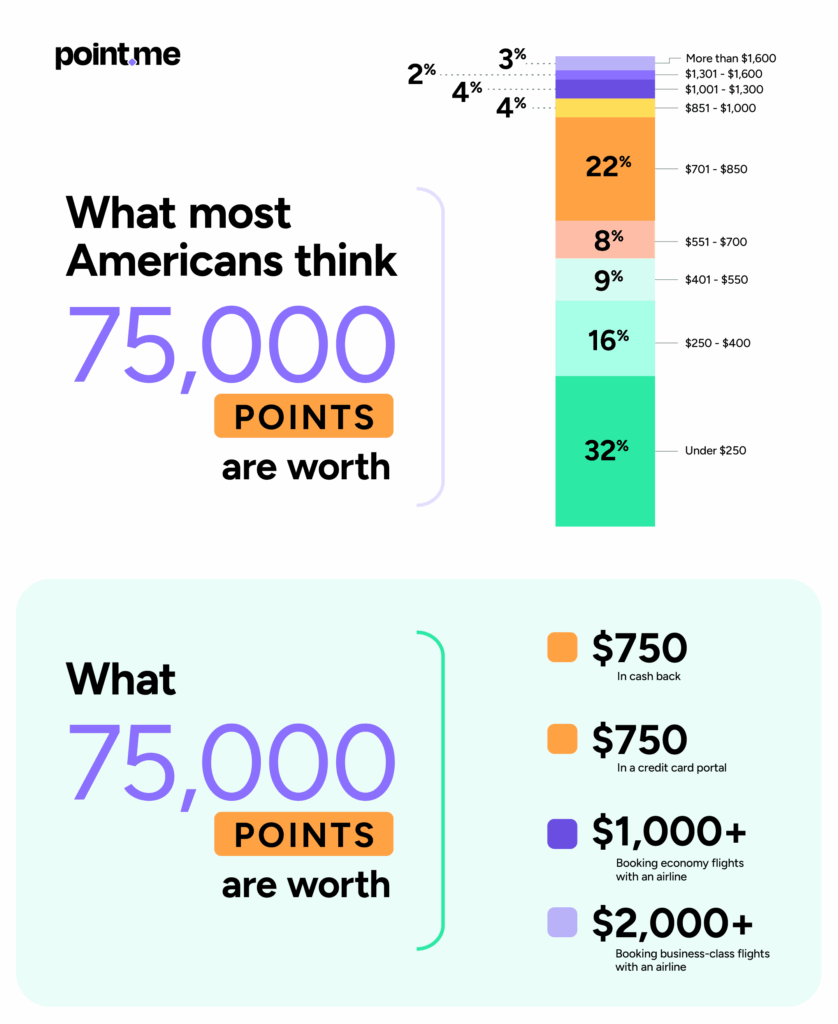

66% drastically undervalue their points, thinking 75,000 points is worth less than $750

23% collect points completely passively, never actively trying to maximize their earning

But here's the kicker: Those 75,000 points they think are worth way less than $750? That’s the minimum those points are worth. They could actually fund a business class award ticket to Asia worth well over $2,200, or cover three to four economy flights to Europe.

The hidden travel wealth breakdown

Among Americans who do know their points balance:

23% have enough for a one-way flight to Europe in economy

Nearly 40% have enough for domestic flights within the U.S.

Many are unknowingly sitting on thousands of dollars in travel value

The awareness gap is so massive that an estimated $300 billion in award points are issued every year,but redemption rates remain surprisingly low. In 2018, McKinsey estimated that 30 trillion unredeemed airline miles exist globally — enough for almost every adult in the U.S. to fly to Europe in business class.

Points as economic insurance

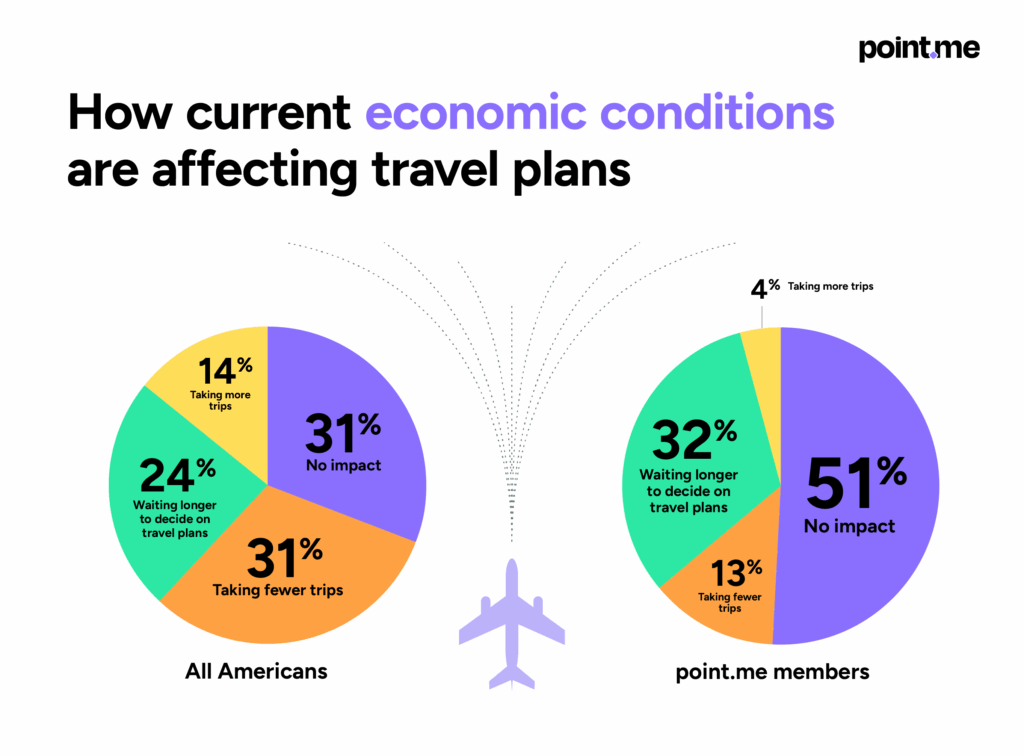

In an era when 55% of Americans are canceling or delaying travel due to economic conditions, points represent something powerful: financial security in uncertain times.

The contrast is striking. While 31% of general consumers are canceling trips entirely this year due to economic concerns, only 13% of point.me members — savvy travelers who understand their points' value — are doing the same. Instead of canceling, 32% are simply delaying plans, and 51% report no economic impact on their travel at all.

While general consumers are feeling the pinch, points and miles can provide a bit of financial security and help consumers outsmart inflation and uncertainty. Instead of canceling plans outright, savvy consumers are leaning on loyalty programs to stay mobile.

The reinvestment revolution

Perhaps most telling is what happens when people unlock their points wealth: they don't just save money — they transform their entire travel experience.

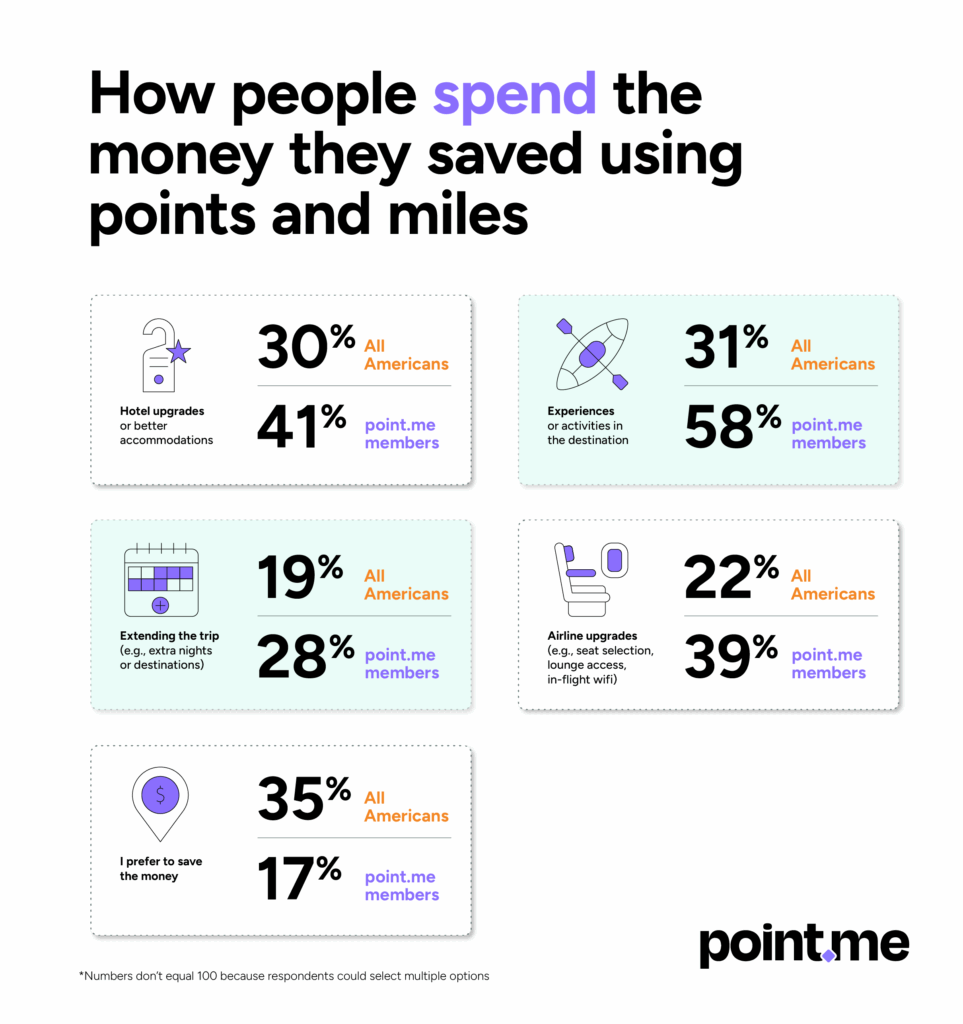

Sixty-five percent of Americans and 83% of point.me users reinvest their points savings into other parts of their trip.

Nearly half (48%) of all Americans put at least a quarter of their savings back into the trip, while 63% of point.me members do the same.

Where does that reinvestment go?

Hotel upgrades or better accommodations: 30% of Americans, 41% of point.me members

Experiences and activities: 31% of Americans, 58% of point.me members

Flight upgrades: 22% of Americans, 39% of point.me members

Trip extensions: 19% of Americans, 28% of point.me members

Points don't just make travel affordable. They make it luxurious.

The psychology of travel wealth

Why do so many Americans remain unaware of their points wealth? The answer lies in perception.

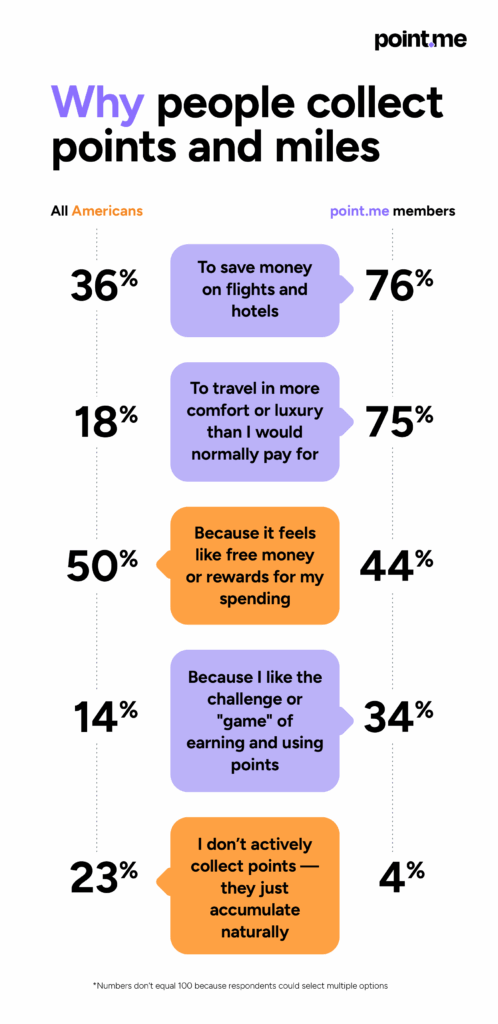

Half of Americans (50%) view points as "free money or rewards for spending" — a nice bonus rather than legitimate financial assets. Only 18% of the general population sees points as a way to access luxury travel experiences, compared to 75% of point.me members.

This psychological barrier keeps billions in travel value dormant. People who think they "can't afford" that dream European vacation or luxury resort getaway are often already holding the key to exactly those experiences.

The power-user phenomenon

The most engaged points collectors represent a fascinating case study in hidden wealth. Among point.me members:

31% hold over 500,000 points — 31 times more than the general population (1%)

40% carry business credit cards compared to 11% of all Americans

76% collect points to save money on flights and hotels

75% use points to travel in more comfort or luxury than they'd normally pay for

These aren't people gaming the system — they're Americans who've discovered that their everyday spending has been quietly building a travel fortune.

The hidden economy emerges

What we're witnessing is the emergence of a parallel travel economy — one where your purchasing power isn't determined by your bank account, but by your points balance.

In this hidden economy:

Everyday spending becomes luxury travel funding

Economic uncertainty matters less when you've pre-funded your trips

The biggest barrier isn't cost; it's awareness

As Cortney C. discovered, the difference between thinking you can’t afford a trip and booking a dream family vacation can be as simple as understanding what you already own.

The question isn't whether Americans have enough points for amazing travel experiences. The question is: When will they realize the fortune that's been hiding in their wallets all along?