Contents

- 1.

- 2.

- 3.

Citi ThankYou points are very valuable if you leverage them correctly. The easiest way to use your points may not provide the best value. Redeeming your Citi ThankYou Points for maximum value will usually include transferring them to an airline or hotel loyalty program. How do you do this?

Today, we’ll walk you through how to transfer Citi ThankYou points to these travel rewards programs, how to share your points with friends, and why you might want to transfer points in the first place.

Citi transfer partners

While American Express Membership Rewards and Chase Ultimate Rewards may have the most talked-about sets of transfer partners, Citi ThankYou Rewards isn’t far behind. We can classify Citi’s partners into two groups: partners shared with other points programs (letting you combine your points from numerous sources into a single airline program) and unique partners (providing value you can’t find elsewhere).

Citi has 19 airline and hotel transfer partners and one retail transfer partner – something unique to the ThankYou Points program. Cit’s current transfer partner line-up includes the following:

Accor Live Limitless

Aeromexico Rewards

Air France-KLM Flying Blue

American Airlines AAdvantage

Avianca LifeMiles

Cathay Pacific Asia Miles

Choice Privileges

Emirates Skywards

Etihad Guest

EVA Air Infinity MileageLands

JetBlue TrueBlue

Leading Hotels of the World Leaders Club

Qantas Frequent Flyer

Qatar Airways Privilege Club

Shop Your Way

Singapore Airlines KrisFlyer

Thai Airways Royal Orchid Plus

Turkish Airlines Miles&Smiles

Virgin Atlantic Flying Club

Wyndham Rewards

How much are Citi points worth?

The value you’ll get when using Citi ThankYou Points varies, depending mostly on how many points you need compared to the cash value of what you’re getting. As a guidepost, One Mile at a Time values Citi ThankYou points at 1.7 cents each. Let’s look at a few examples to help make this point clear.

If you redeem your Citi points as a statement credit, direct deposit, or toward gift cards, they are worth 1 cent each. Alternatively, you can use Citi points to book travel in the Citi Travel portal at 1 cent apiece.

Since you can cash out your points at 1 cent each in value, you should look for a higher redemption value when transferring points to airline and hotel partners. To calculate the value of a redemption, take the cash cost of what you want to book (for example, a flight costing $400) and subtract any cash co-pay you’ll have to pay at the time of booking (in this example, $50).

If booking this flight requires transferring 10,000 Citi points to an airline, you’ll save $350 in exchange for 10,000 points. Divide $350 by 10,000 to get 0.035 — 3.5 cents per point. That’s more than three times the value obtained from cashing out your Citi points, which is an excellent use of points.

How to transfer Citi ThankYou points to travel partners

Step 1: Log in to your Citi account

You can navigate directly to thankyou.com and log in with your Citi username and password. Scroll down to where you see “Total ThankYou® Points.”

If you have multiple Citi credit cards, you’ll see the text “View Linked Accounts;” otherwise, you’ll simply see “Redeem Points.” After clicking on that, a new menu will drop down. Click on “View / Redeem” next to your eligible credit card.

It’s worth noting that Citi credit cards with no annual fee won’t have access to the full list of Citi transfer partners. Only those with the Citi Strata Premier℠ Card or Citi Prestige® Card can access the full list of transfer partners.

Step 2: Choose ‘More Ways to Redeem’

On the next page, look for “More ways to redeem” to transfer points to travel partners or to another person. You may be prompted with a one-time passcode or a notification sent to your phone at this stage.

Step 3: Navigate to Points Transfer

On the next page, you’ll see redemption options and your points balance. Click on “More Ways to Redeem” on the top menu. From the drop-down menu, choose “Points Transfer” to send points to partners.

Step 4: Choose a transfer partner

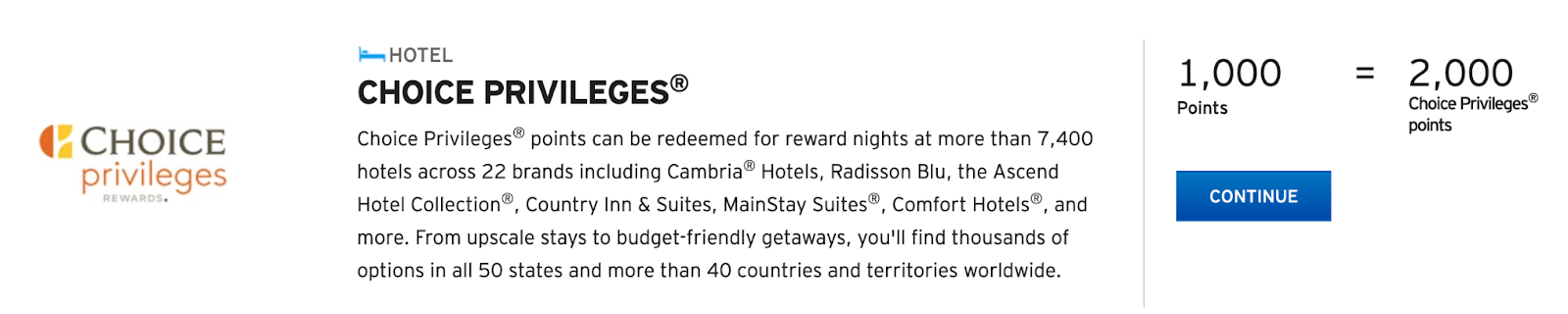

The next page will show a list of the transfer partners you have access to. Scroll down until you find the program you want. In this example, we’re transferring points to Choice Privileges at a 1:2 ratio.

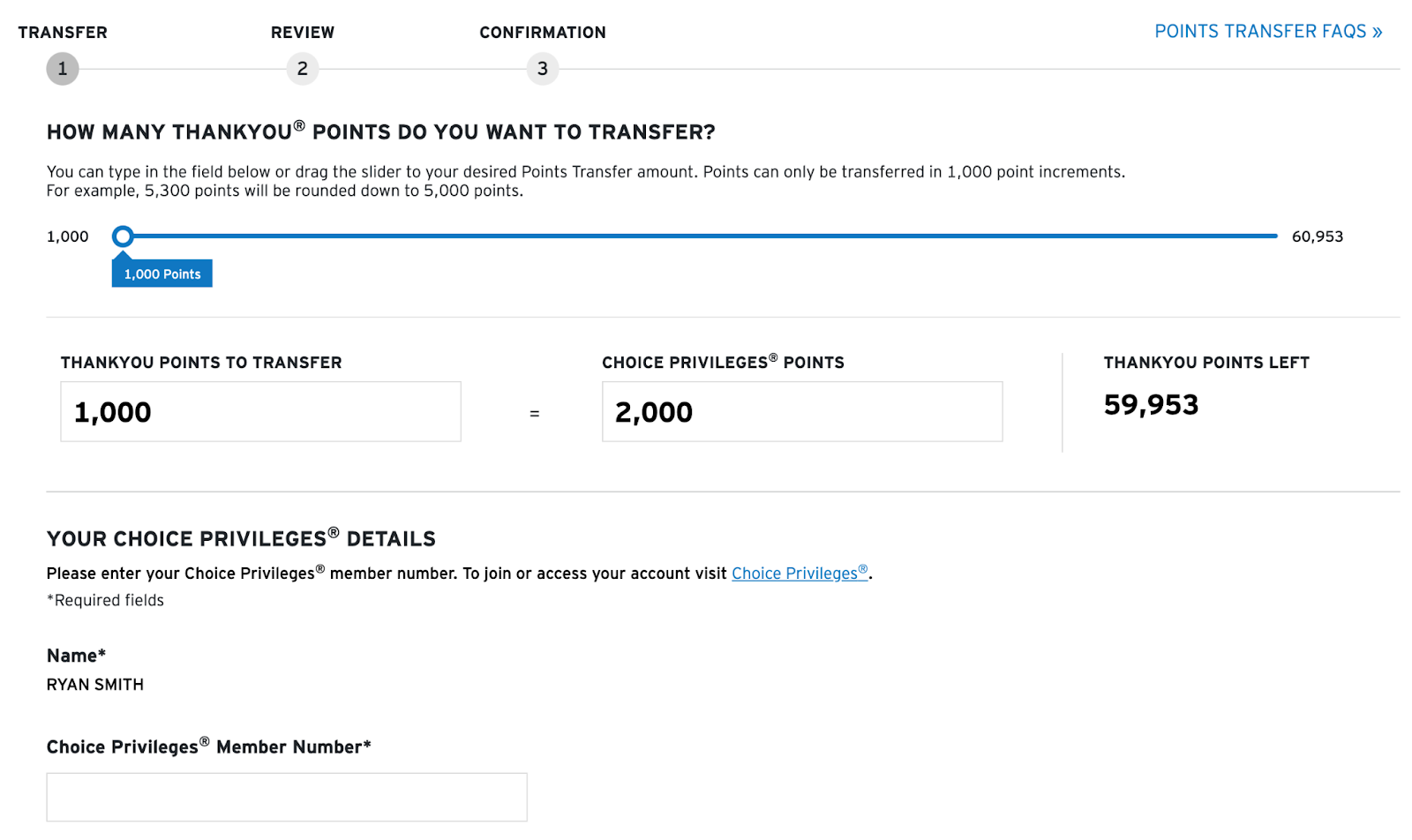

On the next page, you’ll choose how many points you want to transfer. If you’ve never transferred points to this program before, you’ll also need to input your rewards number. You’ll have an option to save the loyalty account number for future use, and you must accept the terms before submitting your transfer.

After submitting your transfer, you may receive another prompt to confirm your identity before seeing the confirmation page. At this point, the transfer is complete, and points are on the way.

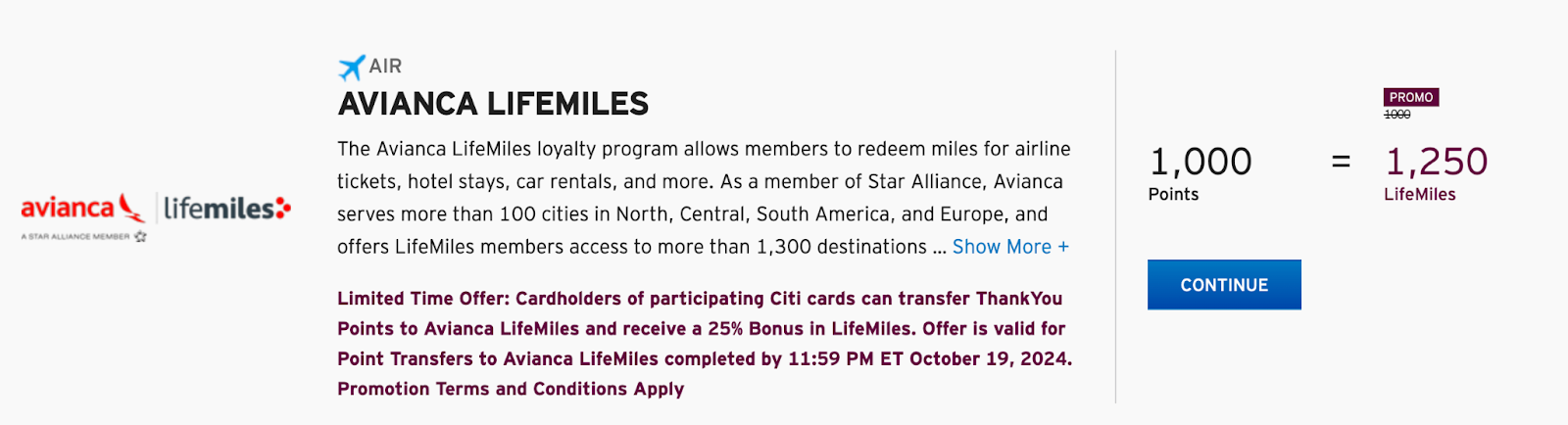

How to transfer Citi points to Avianca

Avianca’s LifeMiles program is among the best airline rewards programs, thanks to reasonable award prices and the fact that it doesn’t impose large fuel surcharges on the cost of booking a flight with miles.

When you see the list of transfer partners, find LifeMiles and click on the “Continue” button. If there are any transfer bonuses available, you’ll see these on the transfer partners list.

Without a bonus, transfers to LifeMIles normally happen at a 1:1 ratio. On the next page, you’ll enter your LifeMiles number and you’ll choose how many points you want to transfer (in increments of 1,000). Accept the terms and submit your request.

How to transfer Citi points to Air France

Air France shares an award program with KLM, the Netherlands’ flag carrier. This shared program is called Flying Blue. Unfortunately, you will pay fuel surcharges and other airline fees on these award tickets – which can be expensive sometimes. However, award pricing can be excellent if you know where to look.

To transfer Citi points to Air France, find Flying Blue on the transfer partners list. Then, click on “Continue” to go to the next page. This is where you can choose how many points to transfer and enter your Flying Blue rewards number.

How to transfer Citi points to JetBlue

Even if you only have a Citi credit card with no annual fee, you’ll still be able to transfer points to JetBlue’s TrueBlue program. However, the rate at which your points transfer will be different.

Those with the Citi Strata Premier℠ Card or Citi Prestige® Card can transfer points at a 1:1 ratio. Those with the Citi ThankYou® Preferred, Citi Rewards+®, Sears Mastercard, or Citi® Double Cash can transfer points at a 10:8 ratio.

If you want to transfer Citi points to JetBlue, find JetBlue TrueBlue on the list of transfer partners and click “Continue.”

On the next page, you’ll choose how many points to transfer, provide your TrueBlue number, and accept the terms before submitting.

How to transfer Citi points to Turkish Airlines

Turkish Airlines Miles&Smiles might not be the first program you think of, but it’s one you should know about, thanks to excellent award redemption rates – particularly domestic flights within the U.S. and Canada on United Airlines or Air Canada.

To transfer Citi points to Turkish Airlines, find Miles&Smiles on the partner list. Click the “continue” button to move to the next page.

On this next page, choose how many points you want to transfer and input your Miles&Smiles number. Finally, accept the terms before submitting your transfer request.

The best Citi transfer partners

Citi has several valuable transfer partners. If we had to choose just three to rank as the best, those would be Choice Privileges, Turkish Miles&Smiles, and Avianca LifeMiles. Here’s why these made the cut.

Choice Privileges

Citi has several hotel partners you can transfer points to. Choice is the best of these for two reasons: the transfer ratio and what you can get with your points.

You can transfer points to Choice Privileges from American Express Membership Rewards, Capital One Rewards, and Wells Fargo Rewards, along with the Citi ThankYou program. Wells Fargo and Citi stand out for their 1:2 transfer ratios to Choice Privileges.

While Choice Hotels aren’t the first many people think of for luxury stays, the program does cross the entire spectrum from budget to bougie and likely has a hotel wherever you’re headed. Considering award bookings start at just 8,000 points per night, you’ll transfer just 4,000 Citi points to Choice for a free stay at these properties.

Avianca LifeMiles

If you’re looking to book flights on a Star Alliance airline, Avianca LifeMiles is a program worth knowing about. Star Alliance includes airlines like United, Air Canada, Lufthansa, Singapore Airlines, and more.

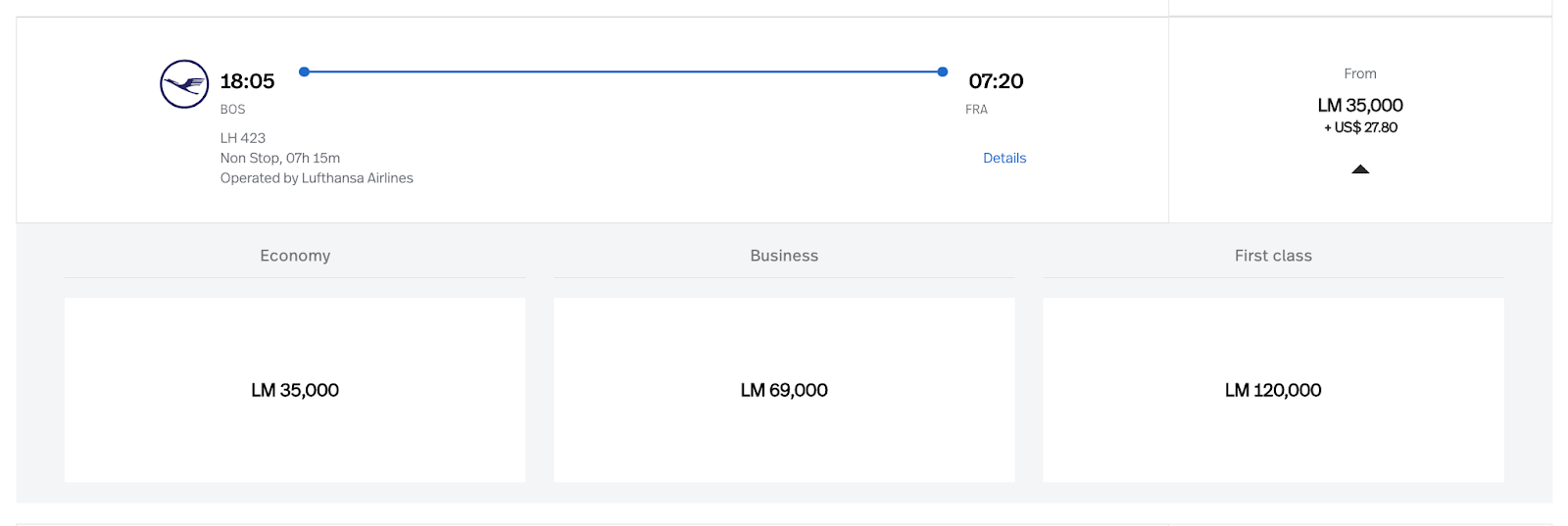

The standout features of LifeMiles are low taxes and fees. If you want to book premium seats on partner airlines, such as Lufthansa first class, you’ll only pay $27.80 for this flight between Boston and Frankfurt, as well as a reasonable 120,000 miles per person.

While it’s true that other programs may charge fewer miles for redemptions, they often impose higher taxes and fees at payment time. Lufthansa’s own program, Miles & More, may charge around $1,000.

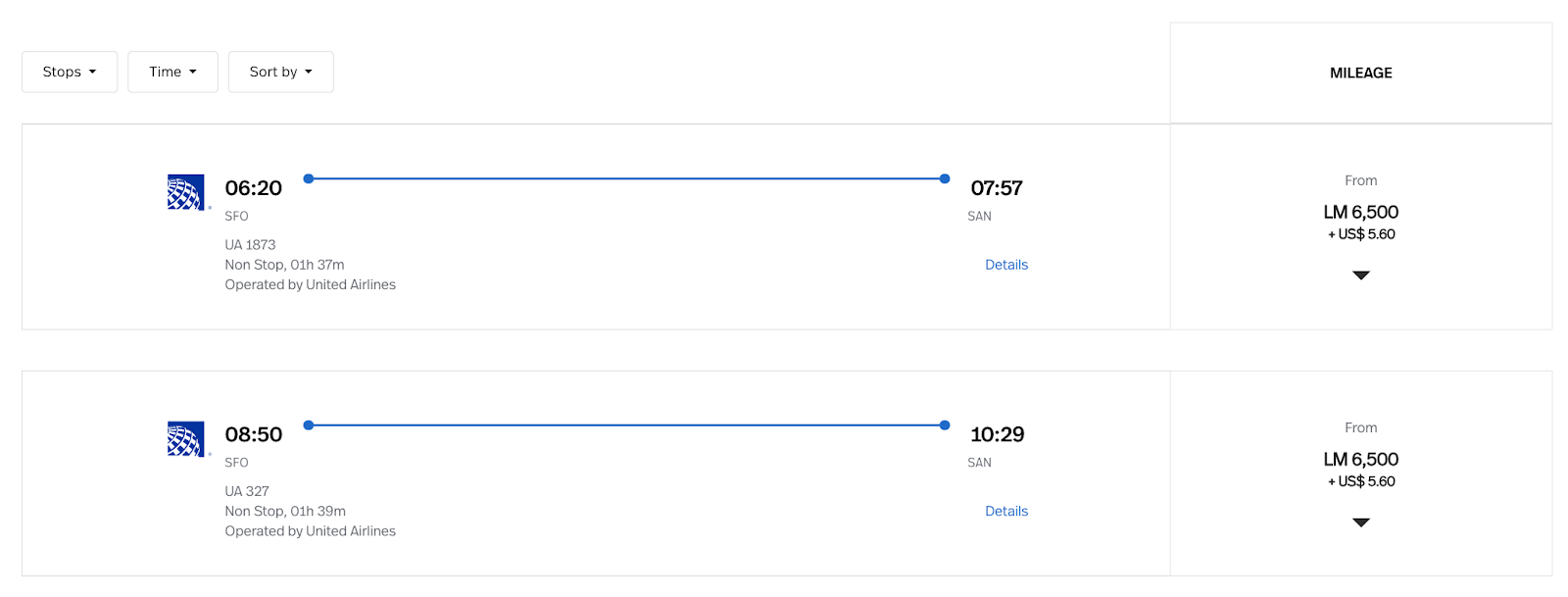

Award pricing with LifeMiles can be attractive, even without considering the cash element. You can pay just 6,500 miles per person for short-distance flights, such as these United Airlines flights between San Francisco and San Diego.

Turkish Airlines Miles&Smiles

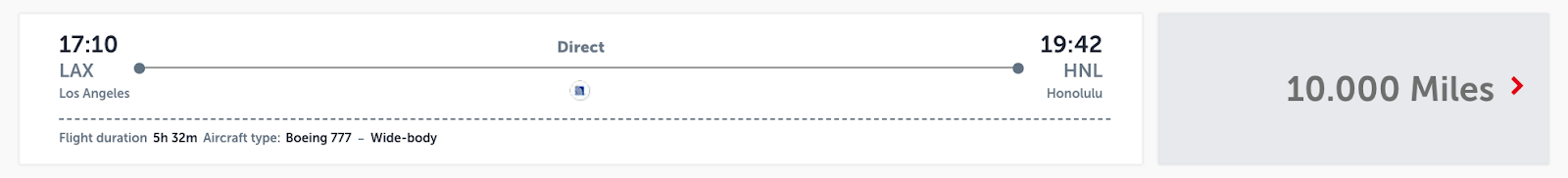

While LifeMiles is great for short-distance flights in the U.S., Turkish Miles&Smiles is especially great for longer United Airlines flights in the U.S.. In fact, you can book domestic United flights starting at 10,000 miles each way in economy class.

That even includes flights to Hawaii departing from either the West or East Coast.

The caveat is that finding award space through Turkish Airlines can require some patience, but the pricing can’t be beaten when you find an available flight that works for your travel plans.

You also can book Turkish Airlines’ excellent business class between the U.S. and Istanbul for 65,000 miles per passenger – another solid use of Miles&Smiles miles.

Tips for transferring Citi points to travel partners

Snagging an award flight or hotel stay with points is exciting. Before you rush to transfer your Citi points to an airline or hotel program, there are a few tips to help you avoid headaches and heartbreaks along the way.

Confirm award availability

Before you send your hard-earned points from Citi to an airline or hotel program, confirm that the travel you want to book is really available. Proceed through the booking process until the final page. Do you get an error? Can you find those same flights using points on a partner airline’s website?

What about award booking tools, such as point.me? Do these show the flight you want to book? If you’re sure the hotel or flight is available, you can transfer points. Until you’re sure, don’t move your points anywhere.

Check other transfer partners

Citi has transfer partners in all three major airline alliances, as well as independent airlines. Across these programs, there are numerous ways to book flights. Can one of these provide a cheaper flight than the option you’re looking at? Before sending your points, explore options to make sure you’re getting the best price.

The airline you want to fly is less important than the method you use to book it. Since there are many ways to book the same flight using points, make sure you’re paying as little as possible, and compare the costs in both points and award taxes and fees.

Check the Citi travel portal

Remember the math we showed on how to calculate the value of your points when booking a hotel or flight? Compare the cash cost against the points you’re using to find the “cents per point” value.

If you’re getting less than one cent per point on a redemption, transferring your points isn’t a good idea. You may be able to book that same flight or hotel using points in the Citi Travel portal. Here, your points are worth a flat one cent each. Make sure you do the math to ensure you’re not using more points than necessary.

How to transfer Citi points between cards by combining your accounts

If you have more than one Citi credit card, your points won’t all end up in the same place — at least not initially. Combining your accounts online can be complicated, but calling the number on the back of your credit card can make this easy. Ask the phone representative to combine the accounts across your Citi credit cards.

This way, you won’t need to move points between credit cards in the future. Going forward, your points will all go into a single pool, no matter which credit card you earn them from.

When to transfer Citi points between cards

You should transfer points to whichever Citi credit card gives you the most redemption options. For example, if you have a card with no annual fee and also have the Citi Strata Premier, you should move all of your points to the Citi Strata Premier. Why? Because you can use all of Citi’s transfer partners with that card.

You’ll also have access to the best transfer ratios with the airline partners using this card. Thus, moving points to your Citi Strata Premier or Citi Prestige will make sense, assuming you haven’t combined your points accounts already. If you’ve combined the accounts, you won’t need to move points going forward.

Moving points to another card or combining accounts will also make sense if you’re closing one of your Citi credit cards. You could lose the points when closing an account unless those points are in a combined account or moved onto another one of your credit cards.

How to transfer Citi points to another person

You can use Citi’s “points sharing” option to send points to a friend’s Citi account. You can share points with anyone you want, but there are a few things to consider before you start the process.

Citi points expire 90 days after you send them to another person, so make sure your friend or relative has a plan for using the points, such as transferring them to a Citi transfer partner.

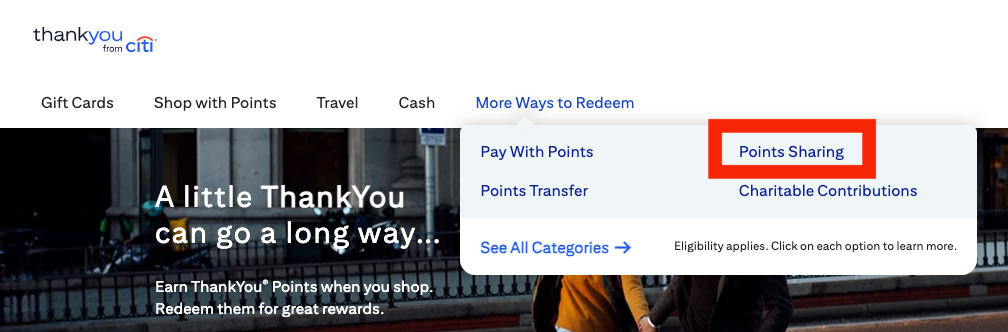

To transfer Citi points to another person, choose “More Ways to Redeem” in the top menu, then click “Points Sharing.”

On the next page, you’ll see some information about points-sharing rules and limitations. Know that you can only send or receive a maximum of 100,000 ThankYou Points annually.

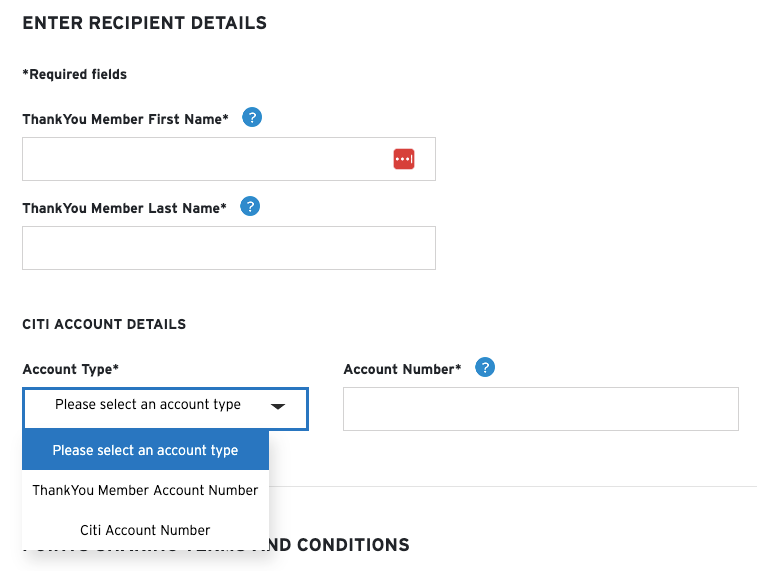

When you proceed to the next page, you’ll choose how many points you want to share and fill out some information about the recipient. You’ll also need to provide the recipient's account number. This can be their ThankYou account number or the number on their credit card.

Finally, you’ll agree to the terms and click “Continue” to submit the transfer.

Frequently asked questions about transferring Citi ThankYou points

Should you transfer Citi points to a partner or redeem through Citi's portal?

You should use whichever option requires the fewest Citi ThankYou points. Remember to always check your options, whether those include multiple transfer partners or just one. Compare how many points you’ll need to transfer to an airline or hotel program against the number of points needed in the portal.

The Citi ThankYou travel portal is easier, as your points always hold the same value, and you don’t have to search for award availability. If a hotel, activity, rental car, or flight is available to book with cash, you can use points towards these costs at one cent each.

Transfer partners provide the opportunity to redeem points at a higher value, but that’s not always true. It also takes more work. If you divide your cash savings by the number of points required and get a number higher than one cent, using a transfer partner is probably a smart idea.

How long does it take to transfer Citi ThankYou points to a travel partner?

Many Citi ThankYou transfers happen instantly, and a few others will be processed within a few hours. However, there are exceptions you need to know about, and you should understand them before starting a points transfer.

If your points don’t transfer instantly, there’s a chance the hotel room or flight you want to book might disappear. You should call and ask for the reservation to be put on hold, if possible while waiting for points to show up. Once they do, you can complete the reservation without losing the room or seat in the meantime.

Transfers that take longer than half a day include Aeromexico (can take a few days), EVA Air (can take up to two days), Qatar and Singapore (up to two days), and Thai Airways (some people report transfering taking up to a week).

Can you transfer Citi points to someone else?

Yes, you can transfer Citi points to someone else, but there are a few rules. First, points expire 90 days after they’re shared, so make sure your friend has a plan to use them, such as booking in the travel portal or sending points to a transfer partner.

Second, those with the Citi Custom Cash® Card can’t share points with others. Moreover, points received from a Citi ThankYou Points-earning checking account can’t be shared.

The good news, however, is that sharing points is free. And you can send and receive up to 100,000 points per year.

Can you transfer points back to Citi once you have transferred them to a partner?

Unfortunately, you can’t transfer points back to Citi once you transfer them to an airline or hotel partner. That means it’s really important that you confirm the flight or hotel room you want is available before transferring Citipoints to a travel partner.

Which cards earn transferable Citi ThankYou points?

Citi Strata PremierSM

Citi Prestige®

Citi ThankYou® Preferred

Citi Rewards+®

Citi Double Cash® Card

Sears Mastercard® credit card

AT&T Universal Rewards World

AT&T Universal Savings and Rewards

AT&T Universal Rewards

AT&T Points PlusSM Card from Citi

AT&T Access More

AT&T Access Card